Understanding the Latest Flood Scores and Their Impact

Understanding Flood Scores

Flood scores have become an essential tool for property owners, real estate professionals, and city planners. These scores provide an assessment of the flood risk associated with a specific area, helping stakeholders make informed decisions. In recent years, advancements in technology and data analytics have refined how these scores are calculated, offering more precise and actionable insights.

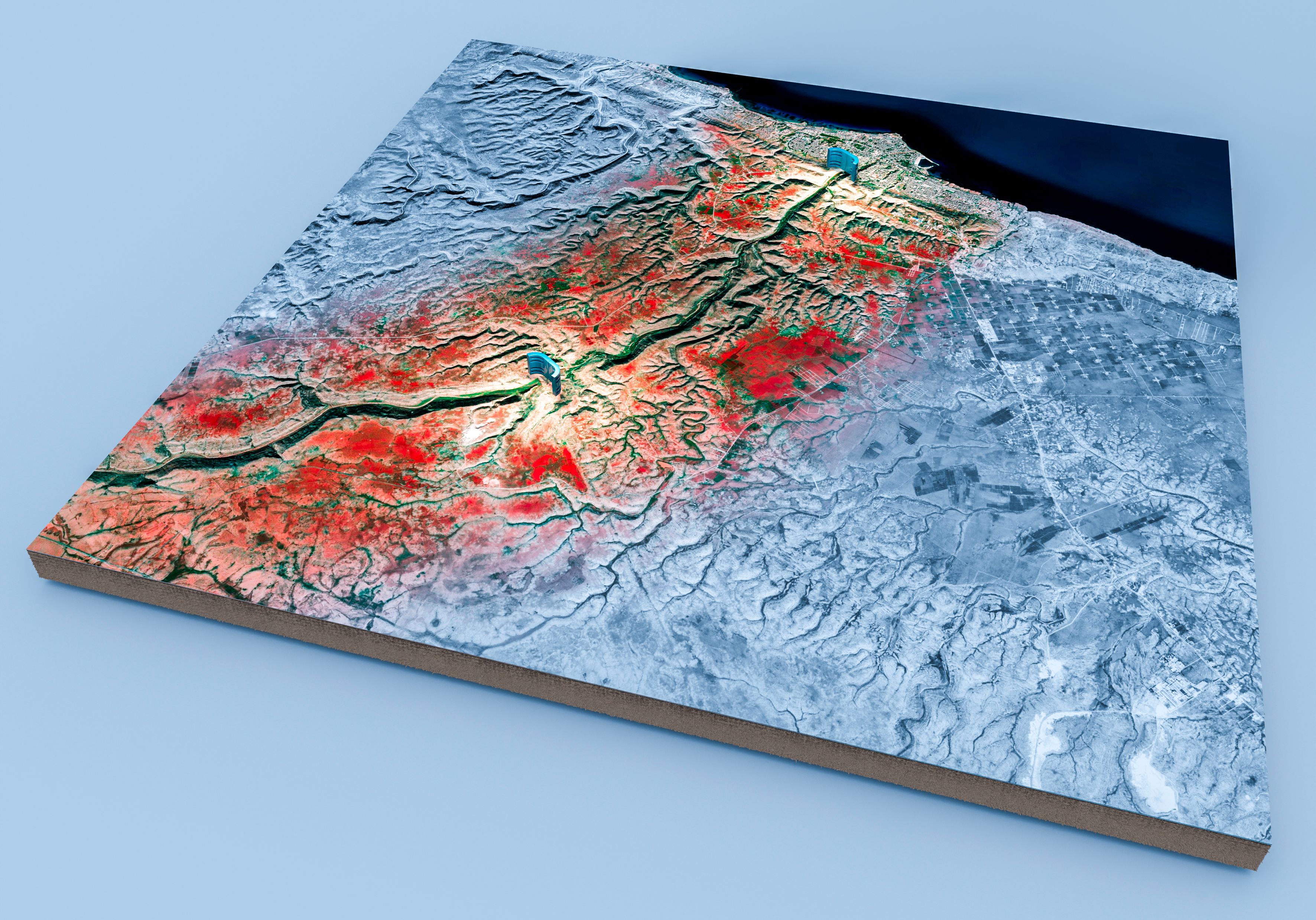

Flood scores are derived from a combination of historical flood data, topographical maps, climate patterns, and predictive modeling. By analyzing these factors, flood scores can indicate the likelihood of a flooding event occurring in a particular location, helping individuals and businesses prepare accordingly.

The Components of Flood Scores

To fully understand the impact of flood scores, it's important to grasp their underlying components. Typically, flood scores take into account:

- Historical Data: Past flood events and their frequency in the area.

- Geographical Information: Elevation, proximity to water bodies, and natural barriers.

- Climate Trends: Current weather patterns and climate change projections.

- Infrastructure: Existing flood defenses and drainage systems.

These components work together to provide a comprehensive view of potential flood risks, allowing for better preparedness and risk management.

Impact on Real Estate and Development

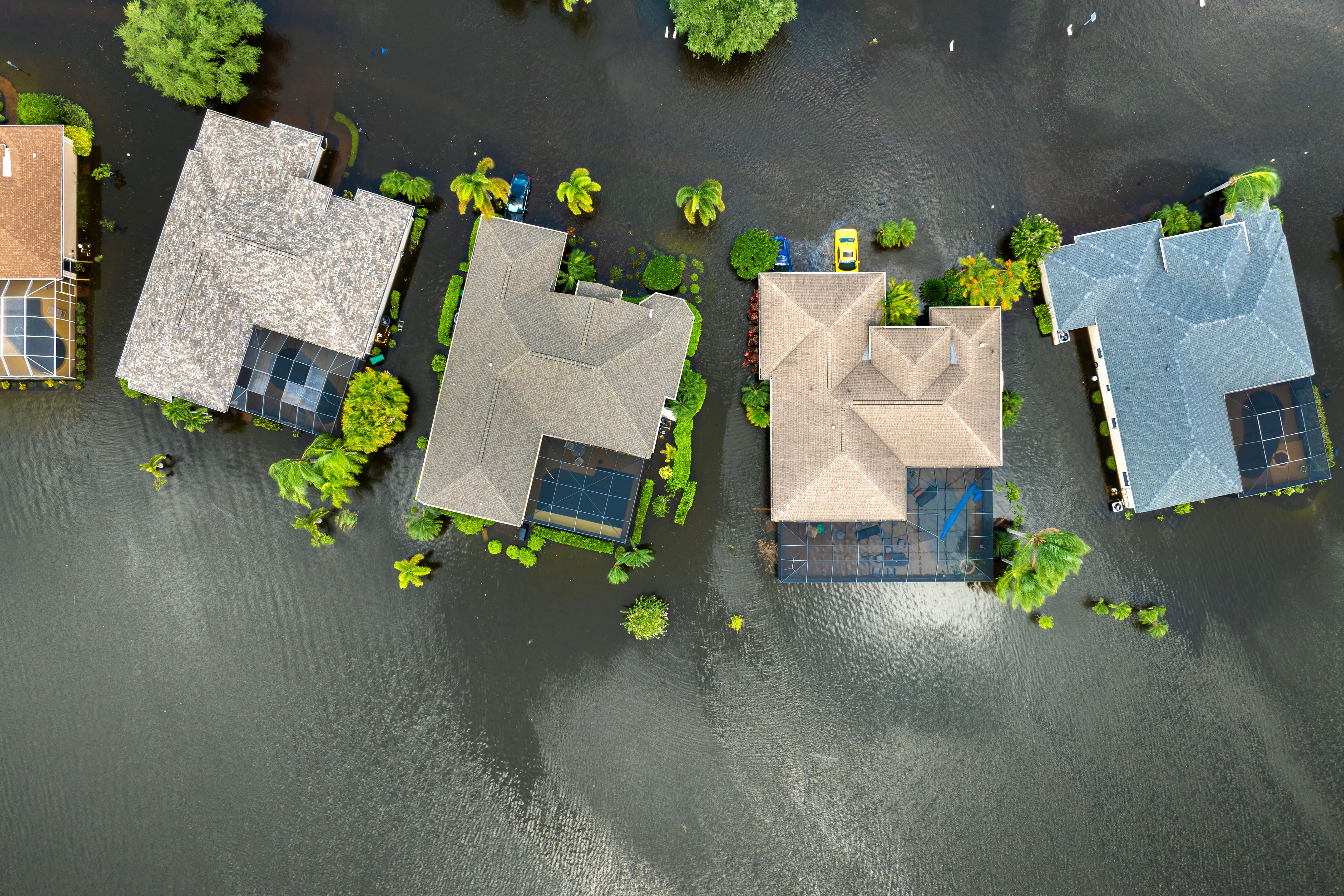

Flood scores significantly affect real estate values and development decisions. Properties in high-risk areas may face reduced prices, higher insurance premiums, and stricter building regulations. Conversely, areas with low flood scores may see increased demand and investment opportunities.

Urban planners and developers use flood scores to design resilient infrastructure, ensuring that new projects can withstand potential flooding. This proactive approach not only protects property investments but also safeguards communities from future disasters.

Insurance Implications

Insurance companies heavily rely on flood scores to determine policy terms and premiums. Properties with higher flood scores often face increased insurance costs, reflecting the elevated risk. Understanding your property's flood score can help you negotiate better terms or explore mitigation measures to potentially lower your premiums.

For property owners, investing in flood mitigation strategies—such as improved drainage systems or elevated structures—can make a significant difference in both safety and insurance costs.

Utilizing Flood Scores for Community Planning

Communities can leverage flood scores for effective disaster preparedness and response planning. By identifying high-risk areas, local governments can prioritize infrastructure improvements and emergency response strategies, minimizing the impact of potential flooding events.

Public awareness campaigns and educational programs about flood risks and preparedness can further enhance community resilience, ensuring residents are informed and ready to act when needed.

Conclusion

Understanding the latest flood scores and their implications is crucial for property owners, developers, insurers, and communities. By utilizing these scores, stakeholders can make informed decisions, enhance safety, and reduce financial risks associated with flooding. As climate patterns continue to evolve, staying informed about flood risks will be an increasingly important aspect of property management and community planning.